Singapore 2H24 Outlook: We Found Growth in A Hopeless Place

Despite growth concerns around the world, Singapore manages to have a strong showing in 1H24, more of the same is expected in the 2nd half.

2Q24 GDP comes out strong, reflecting advanced estimates’ figures. Strong growth pushed MAS to narrow their GDP forecasts for 2024 from 1%-3% to 2%-3% now. This week’s article will focus on the macroeconomic pathway Singapore might take for the rest of 2024. TAM also retains our view that MAS will ease monetary policy via a slight S$NEER slope reduction in the Oct 24 meeting.

Headline Growth Maintained, But Its Composition Shifts

Final 2Q24 GDP figures come out to 2.9% (1Q24: 3.0%), the same as the advanced estimates.

Manufacturing saw a stark downward revision (Final 2Q24: -1.0%; Advance Estimates: 0.5%), similarly, construction saw some revisions (Final 2Q24 3.8%; Advance Estimates: 4.3%)

Upwards revision in Services (Final 2Q24: 3.7%; Advance Estimates: 3.3%) made up for the loss in manufacturing and construction growth.

Manufacturing Weakness from the Biomedical Sector

Source: Singstat, TAM

Outside of the post-pandemic rebound, the manufacturing sector has been rather weak in Singapore, with 5 of the last 6 quarters being contractions.

We see this persistent contraction as a result of global weakness in the biomedical sector.

The higher frequency NODX data points to exceptionally weak pharmaceutical exports as of late, replacing electronics NODX as the main laggard.

It should be noted that global pharmaceutical demand tends to be volatile as patents-expirations and quick technological development in health sciences lead to a fast-changing demand profile. Pharmaceutical demand will likely rebound in the coming months, potentially even before 2025.

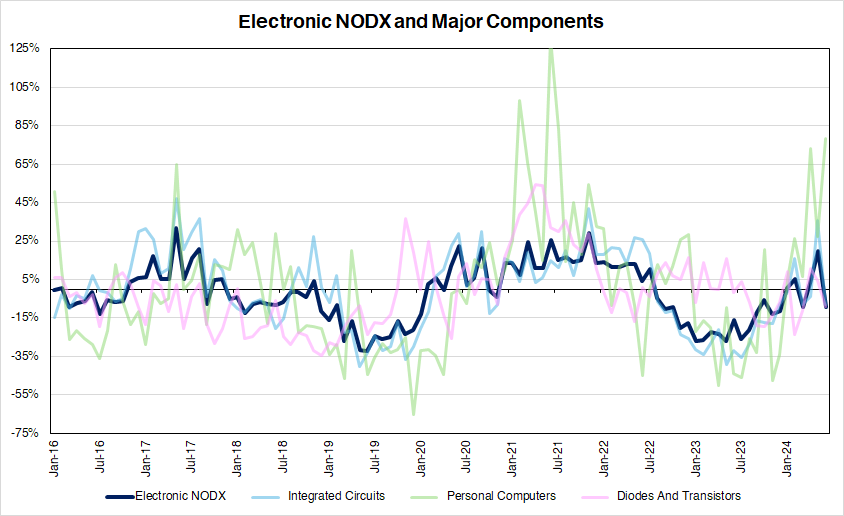

Source: EnterpiseSG, TAM

Meanwhile, electronic manufacturing output is on the mend despite some temporary hiccups.

The semiconductor upswing is well underway with Singapore benefitting from increased global demand in Integrated Circuits (IC).

Singapore tend to produce trailing-edge CMOS IC Chips which are generally not used in AI applications and data centers. It is unlikely that the recent AI hype is the cause for the upturn.

This upturn is expected to persist through 2024 as we expect a stronger recovery in demand for electronic products in the 2nd half of the year.

Firstly, Global monetary easing is expected to begin soon, if not in 3Q24, at least in 4Q24. Recent US CPI points towards a sustained disinflationary trend which would encourage the US Fed to begin easing soon.

Rate cuts in the US will likely fire the starting gun for global central banks to begin easing as well. A looser monetary policy is expected to improve investor sentiment and encourage capital spending which would benefit electronic and precision engineering manufacturing in Singapore.

Secondly, PC and smartphone-related IC Chip output will likely benefit from seasonal strength in 2H24 as we enter the season for product launches.

Apple has historically launched its yearly update of iPhones, iPads, AirPods and Apple Watch in 3Q.

To support these launches, the manufacture of these electronic products will likely begin to ramp up, boosting global demand for trailing edge IC Chips and PC which Singapore produces.

Furthermore, 4Q24 will also see some boost for these segments due to holiday spending and increased purchases of electronic goods as gifts.

Source: Singstat, EnterpriseSG, TAM

Lastly, the Singapore electronic inventory cycle is drawing down, boosting the need for increased electronic output.

In line with the global electronic cycle, Singapore appears to have begun to offload its inventory position that it accumulated in 2023.

After 1-2 months of continued destocking, the inventory cycle will likely return to growth and boost the need for electronic output.

This means that 2H24 will see more Singaporean output as inventory has to be restored while fulfilling oncoming orders.

NODX will likely come out to be 4.4%-4.5% by the end of the year, despite tailwinds from the electronics sector, the much larger non-electronics NODX will suffer from pharmaceutical export weakness.

External Demand Boosts Services, Tourism Still a Concern

Source: Singstat, TAM

Much like manufacturing, external-facing services like wholesale trade and finance are set for a 2H24 boost. It appears that the external demand is beginning to pick up again and this is the start of a new upcycle.

This bodes well for finance services which grew at an impressive 6.7% y/y (1Q24: 7.1%), this could be attributed to the financial markets beginning to price in looser monetary policy.

Fund managers and bankers would benefit from greater flows into the APAC region which raised commission levels in 2Q24. We see no reason why this trend would reverse for the rest of 2024, the markets have been pricing in larger and larger cuts (maybe too large) which may help boost the case for fund flows towards Singaporean managers.

Source: Singstat, TAM

The typically stable Consumption Sector has behaved as expected by most but there is cause for future optimism in this sector.

As mentioned in “Where will Singapore Interest Rates go?”, the inflationary effects from the GST hike should have flattened out as locals adapt their price expectations to the new normal. With the recent payment of the SGD850 GST Voucher to citizens earning less than SGD34,000 annually, consumption is expected to experience a slight boost.

The focus on handouts to lower-income Singaporeans will likely benefit the hand-to-mouth consumers the most, resulting in more consumption in the local economy.

That said, while it is likely that the SGD850 handout will encourage some spending, we still note that Singaporean consumers are still facing significant cost-of-living challenges and weak structural welfare policies.

This may dampen the consumption boost from the voucher as many may opt to deleverage or save money to ensure that they have enough financial buffer for any unexpected expenses.

Source: Singstat, TAM

Tourism has faced a spotty recovery picture as figures are still below the pre-pandemic level and growth seems to have plateaued.

Many attribute tourism’s weakness to China’s lacklustre recovery, however, that is unlikely the sole reason for Singapore’s poor tourism figures.

What we see is that the other major Asian sources of visitors have also posted figures lower than pre-pandemic levels.

The number of visitors from India and Indonesia has also been as weak as China’s figures. Interestingly, Western sources are back at pre-pandemic levels.

It is not immediately clear to me why this weakness seems to concentrate only on Asian visitor sources, I have a general guesses as to why.

I believe that this could be symptomatic of the weakness in demand for leisure travel, therefore, only business visitors are returning to pre-pandemic levels.

This theory suggests that the broad Asian middle class is still under some financial pressure which disincentivizes travel to the more expensive Singapore.

Regardless, until business picks up in Asia, middle-class leisure travel will likely remain lacklustre and business travel will dominate the figures.

In short, Services as a whole should benefit from the global easing cycle, external demand can fuel increased demand for Singapore services while softening inflation builds the case for stronger demand for domestic, non-tradable services growth. However, poor tourism figures may be a domestic services demand headwind, as Asian visitors continue to plateau and struggle to recover to pre-pandemic levels.

Despite headwinds from the biomedical sector and tourism, services export and electronic upcycle will be a strong boost for the Singaporean economy. Continued strength is expected in the 2nd half of the year, TAM forecasts GDP to end the year at 2.9%-3.0%.

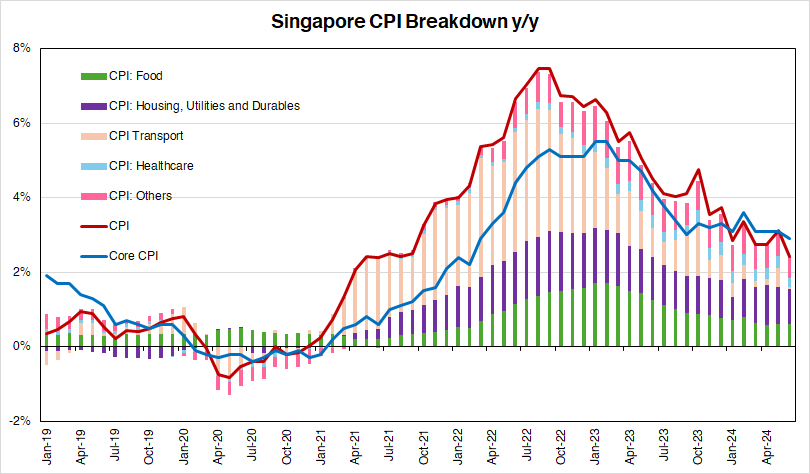

Disinflation Continues on Cheaper COEs

Source: Singstat, TAM

Jun 24 inflation sinks to 2.4% y/y (May 24: 3.1%) as core figures soften greater than market expectations (Jun 24: 2.9%; May 24: 3.1%; Forecasts: 3.0%).

Disinflation is broad-based, Transport (Jun 24: 0.3%; May 24: 2.9%), Healthcare (Jun 24: 3.9%; May 24: 4.2%) and Apparel (Jun 24: -1.8%; May 24: -0.6%) have all exhibited strong disinflationary influence with the apparel basket entering its 4th straight month of deflation.

Transport has been notably soft as the recent surge in COE quota issuance lowers COE premiums for private transportation for both cars (Jun 24: -2.2%) and motorcycles (Jun 24: -7.9%).

This is driven by LTA’s attempt to smoothen out the seasonality patterns in COE premiums due to uneven issuance of quotas. Future COE issuances will be brought forward into 2024 to boost the number of COEs available for bidding.

This cut-and-fill strategy will exert a temporary deflationary effect on transport inflation. Furthermore, since transportation is part of the non-core basket in Singapore, this cut-and-fill strategy has led to outsized disinflation in headline figures.

Housing inflation (Jun 24: 3.7%; May 24: 3.8%), Food Inflation (Jun 24: 2.8%; May 24: 2.9%) and Recreation inflation (Jun 24: 4.7%; May 24: 5.0%) have remained rather sticky.

Recreation inflation has been continually pushed up by supply chain issues in the tourism sector with Holiday Expenses (Jun 24: 5.6%) continuing to stay elevated despite some moderation from the previous month.

More significantly, Recreation inflation (alongside food inflation) is pushed upwards due to imported inflation.

Recreational IT Products (Jun 21: 5.1%) and Food Inflation have remained persistently strong with the former rising by more than 2% in June.

This pattern is expected to slowly edge down as global market volatility has strengthened the SGD to near all-time highs. It is likely that we are at the tail end of the imported inflation trend as further strength in SGD is expected with the global monetary easing cycle begins.

TAM expects CPI to end 2024 at 2.4%-2.6% y/y with Core CPI hitting 2.8%-2.9%. Significant disinflation will likely only occur in 2025 as favourable base effects pass through into the figures.

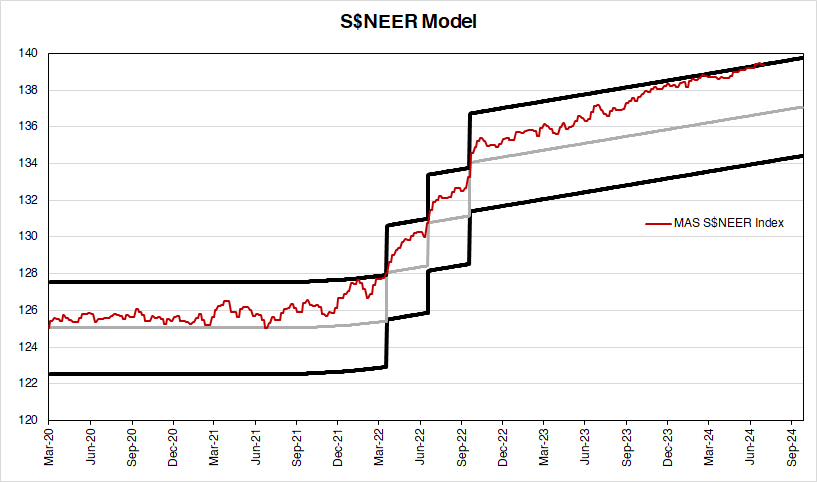

SGD Strengthens from Market Volatility

Source: MAS, TAM

Since the start of the year, the SGD has generally depreciated after a strong correction in 4Q23. This has less to do with Singaporean fundamentals and more to do with dollar-positive sentiment caused by delayed rate cut expectations.

However, the SGD rapidly gained strength amidst rampant market volatility at the beginning of Aug 24.

A rather hawkish BOJ meeting ended in the second rate hike for the Japanese in 2024, taking policy rates to 0.25%. They also announced a trimming of bond purchases, marking a significant step in tightening monetary policy.

Market exuberance led to a quick strengthening of the JPY which unwinded speculative positions and strengthened the SGD.

Its strengthening was amplified by poor US labour data, causing speculators to panic and price in a recession. This panic weakened the USD, which provided an additional boost to the SGD, allowing it to appreciate towards USDSGD 3.14, which was near all-time lows.

However, an additional swing was observed amidst robust Jul 24 US Retail Sales data which allayed some investors’ fears of a recession. This led to another USD-positive sentiment that depreciated the SGD.

Wild swings in the FX market are a significant risk fact but the SGD is supported by several structural factors.

Singapore’s exchange rate policy sets market expectations for an appreciating SGD. Regardless of worries in the wider FX market, traders will imbue an underlying appreciation assumption which bodes well for SGD strength

Despite some depreciation due to market repricing of a US recession, the SGD has managed to hold onto a significant amount of its strength. Further evidence that, relative to other Asian currencies, SGD tends to remain somewhat stable in a rate volatile environment.

Historically, when the US begins its cutting cycle, the USD has generally depreciated as investors adopt a risk-off mindset. A situation that will likely continue regardless of US Presidential Election results.

The Presidential Election is likely dollar-neutral as both candidates look to deepen the fiscal deficit. The results of the House and Senate races are likely more consequential.

A hung government will generally be dollar-positive as spending or tax cute plans will meet some legislative hurdles, leading to lower expected issuances, and softening depreciationary pressure from the rate cut cycle.

A fully partisan government will generally be dollar-negative as the probability of either candidate’s fiscal plan being executed will improve. Leading to more deficit spending, and boosting depreciationary pressure from the rate cut cycle.

Current factors suggest that the SGD will keep its strength into the rest of 2024, a strong case for continued moderation in imported inflation.

MAS Monetary Policy

MAS’s Jul 24 Monetary Policy Statement states that

MAS expects both Core and Headline inflation to continue its disinflationary journey in 2H24

MAS expects 2H24 economic activity to remain strong on US strength and China’s export growth. Broad tech upturn to benefit Singapore’s manufacturing and financial sector.

Geopolitical tensions present a possible upside risk to inflation

Higher-for-longer rates present a possible downside risk to inflation and growth prospects.

MAS's statement suggests that they do not expect further issues with inflation and growth in 2024. While they identified some possible risk factors, it is unlikely that either will come to fruition, or deviate too far from current expectations. The situation is perfectly set up for policy to be normalized in lockstep with the rest of the world.

Barring any material changes to domestic inflation and global policy rate-cutting pathway, TAM expects a slight reduction in the S$NEER slope in MAS’s Oct 24 meeting