China Dollar Bond Curve Reveals Corp Bonds Opportunity

The tale of two markets shows a reversal in sentiment in the US and China. Chinese USD Corporate Bonds could be the play

China’s Dec 24 USD 2bn bond issuance raised eyebrows worldwide as it commanded an incredible 20x bid-to-cover ratio. For comparison, the typical UST issuance has a 2x-3x bid-to-cover ratio. This impressive demand volume also shows that, while only rated at A+, investor demand for Chinese debt is comparable to US Treasuries (UST) with China Government Bond (CGB) yield premiums at 1-3bps at issuance.

Telok Ayer suggests that this strong CGB performance signals an opportunity in Chinese USD corporate debt, particularly if China’s economic sentiment continues to recover. This thesis rests on three key drivers:

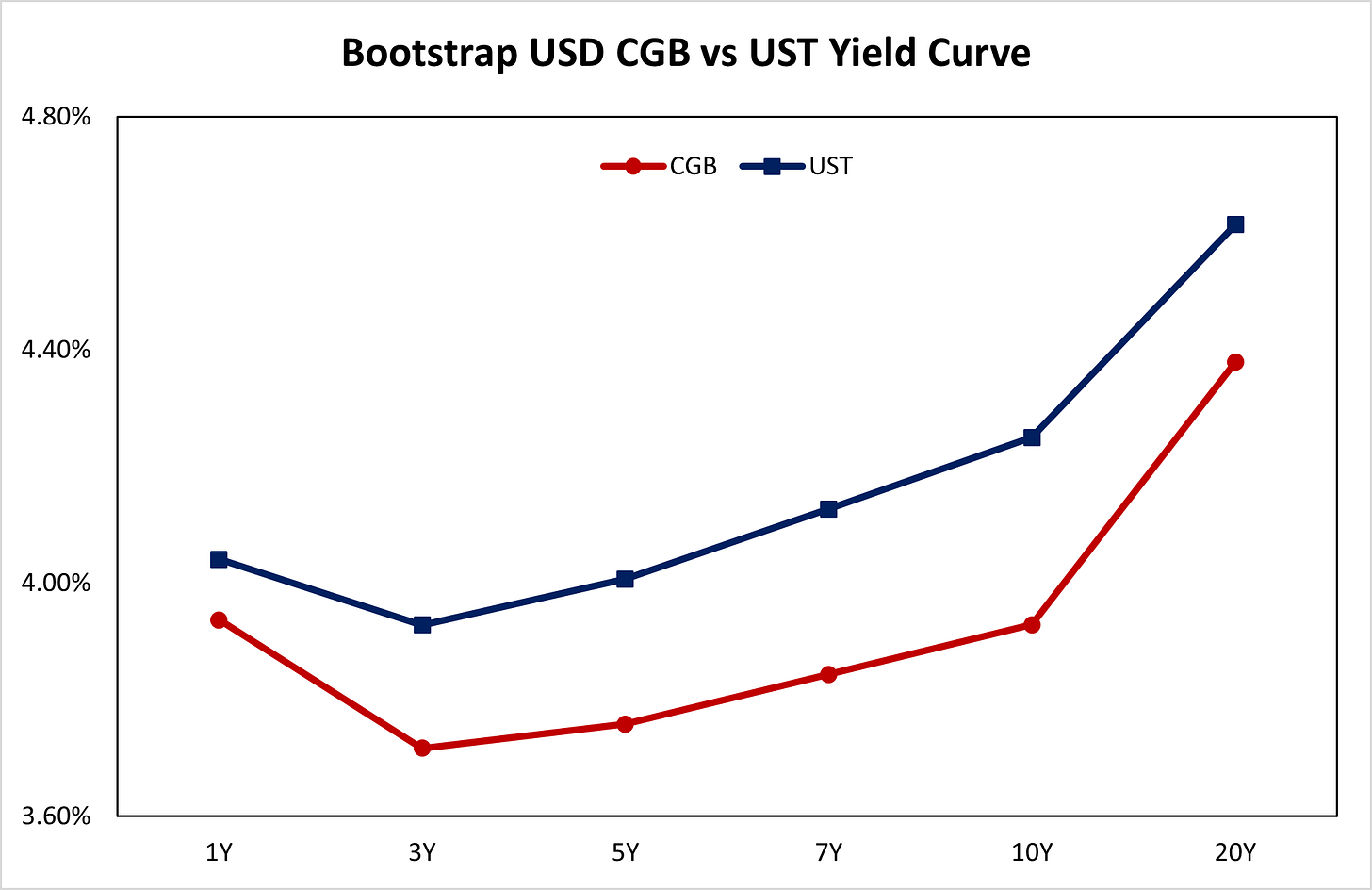

1. China’s USD bond curve shows that Kung-Fu Bond yields are significantly lower than USTs.

2. Chinese corporate spreads are narrowing amid improving sentiment.

3. U.S. corporate spreads are widening due to volatile policy signaling.

Chinese Dollar Bond Curve

The Dec 24 issuance of Chinese Bonds denominated in USD was likely done to maintain a dollar bond curve as its USD2.25bn Oct 20 tranche of 5y USD CGBs, colloquially known as ‘Kung Fu Bonds’, was poised to mature in 2025. A dollar bond curve is crucial for China, providing a benchmark for pricing Chinese USD corporate bonds. Without it, companies may face higher yields as investors price in both sovereign and corporate credit risk. With a clear bond curve, investors can price bonds more efficiently, using the established yields as a reference and adding only company-specific risk premiums.

Kung Fu bonds are trading at a negative premium to USTs across all tenors, which might appear to suggest that the market views China as more creditworthy than the US. However, this is a bold assumption. Weak investor sentiment in China, lower liquidity in Kung Fu bonds, and tax advantages for Chinese investors have likely distorted yields, as investors flock to China Government Bonds (CGBs) instead.

While the claim that China is more creditworthy than the US is probably untrue, the low yields in Kung Fu bonds do suggest strong demand for USD-denominated Chinese debt. It benefits investors seeking USD exposure while avoiding UST market volatility, driven by tariff uncertainty and a slowing disinflation trend. Given the likelihood of continued price swings, the 3-year tenor appears the most attractive entry point.

Kung Fu bonds could be a viable alternative to USTs where market participants look to benefit from the strong Chinese demand while avoiding US uncertainty. Further capital appreciation could be gained by riding down the yield curve, benefitting from the natural price appreciation as the bond nears maturity.

There are limits to such a strategy, of course. The Kung Fu bond market is much more illiquid than the UST market, and hold-to-maturity market participants will suffer from the much lower yields. Institutional investors might also avoid such strategies due to the lack of market depth and the possibility of large entries distorting prices.

China Corporate Yield Spreads

The past few weeks have been a tale of two markets. Previously assumed continued US exceptionalism has all but crumbled. Meanwhile, Deepseek-derived optimism drove the Chinese market sentiment. The bond market of both economies is experiencing a diverging path, one which suggests that Chinese assets might be more attractive than US ones in the near term.

Unlike the US, Chinese corporate credit spreads have already peaked and will unlikely to widen in the remaining months of 1H25. As such, overweighting on Chinese USD corporate bonds would be a relatively safe play. This view is largely down to 3 key drivers:

1. China’s economic weakness is already priced in.

2. Policymakers have adopted a more dovish stance.

3. China’s reliance on U.S. exports has significantly declined

China’s economic weakness is already priced in

Firstly, the story of 2024 has been solely focused on the Chinese economy malaise. Poor consumption figures, the real estate market downturn, deflationary concerns and President Xi’s crackdown on the private sector were all reasonable fears. The extended timeframe in which these sentiments have been playing out in the market suggests to me that these factors have likely been priced in.

At first glance, the narrow corporate credit spread suggests the market is brushing off growth concerns. However, China’s capital controls limit investment options, pushing domestic investors into corporate bonds. Falling yields, therefore, signal poor sentiment, not optimism, as investors seek refuge in bonds due to a lack of alternatives rather than private sector confidence.

However, a distinction must be made, falling yields reflect constrained choices while rising yields indicate active risk aversion. In 2025, a corporate bond sell-off driven by tariff fears led investors to flee to safer government bonds. This shift highlights that while limited options can sustain a bond rally, severe risks prompt an outright flight to quality.

In general, I am partial to the idea that the Chinese asset market has priced tariff risk, growth risk and regulatory risk perfectly. The main pessimistic narrative in China has not budged since the lockdowns were lifted. As such, downside risks are likely limited here on out unless pent-up exuberance takes hold in the market.

Concerns about Chinese corporate balance sheets are valid, given recent real estate defaults and USD30bn in missed private sector bond payments. The key is to stick to investment-grade or State-Owned Enterprise bonds. Since this thesis hinges on macro trends, adding credit risk by holding weaker issuers would be an unnecessary gamble

Policymakers have adopted a more dovish stance.

Secondly, Chinese policymakers’ upfront dovishness does point towards the bottoming out of the Chinese corporate bond market earlier in the year. I would note that the National People’s Congress, the PBOC, and even President Xi himself have been on the same page in terms of market signals. They all seem to agree in desiring a large stimulus plan which would be focused on boosting consumer and investor sentiment. Xi’s administration has consistently prioritized pragmatism, ensuring state resources are mobilized to meet clear objectives.

As such, betting against a bond rally in 2025 is effectively betting against President Xi’s ability to achieve his targets. NDRC has outlined the CCP’s desire to transition to a consumption-based economy. The PBOC has repeatedly signalled their intent to loosen monetary policy to support the economy, especially in anticipation of large tariffs from the US. The larger political machinations have already shifted their focus to boosting economic activity. To be fair, the efficacy of such policies may be questionable but I expect stimulus measures to become progressively more drastic as the CCP chases their goal of 5.0% growth.

The question is not if the bond market will rally but when. Without a crystal ball, I can only speculate on the catalyst. The scenario I lean towards is the harsher-than-expected Trump tariffs on 2 Apr 25. While insiders hinted at a narrower tariff scope, China remains vulnerable due to its large trade surplus and recent retaliatory tariffs. A significant tariff hike could push the PBOC to implement long-hinted monetary loosening, triggering a liquidity-driven bond market rally. Regardless of the exact timing, going long on Chinese corporate bonds, especially Kung Fu bonds is the most ideal risk-adjusted play now, especially if you have confidence in Xi to walk the talk.

China’s reliance on U.S. exports has significantly declined

Lastly, we note some interesting structural readjustments in the Chinese economy since Trump’s first term. China has seemingly de-risked from the US economy, or at the very least its direct reliance on the US market has been strongly reduced.

China's reduced reliance allows it to better resist Trump's strong-arming. Although the US remains the global source of final demand, it is impossible for the US to completely exclude Chinese value-added activities. Thus, while market sentiment may shift strongly due to tariffs, the actual material impact on China may be muted compared to Canada or Mexico. Despite some near-term troubles in Chinese markets due to trade war escalations, the new buffer created by Chinese "de-risking" means broader domestic factors will be more significant than Trump's tariff expansion. This is a key assumption in this article.

In short, all 3 drivers point to the same thing: Chinese corporate bonds, especially USD-denominated ones, are the most ideal now for investors who seek safe, risk-adjusted returns. There is a material downside risk in Chinese corporate bonds due to shifting market sentiment, however, such turmoil might be buying opportunities for market participants with a strong risk appetite.

US Corporate Yield Spreads

While the Chinese corporate bond market will likely rally in the coming weeks, I expect the opposite in the US. The early days of the tariff war were characterised by dollar-positive sentiment, many were excited to see investment and manufacturing return state-side. Recent weeks have reversed such narratives as growth fears take over the on-shoring optimism.

Compared to China, the US have been facing a crisis of confidence. The recent release of Deepseek’s AI model has brought about fears of an overinvestment in AI infrastructure and models.

Since the Deepseek-driven sell-off, retail sales, consumer confidence, and trade figures have disappointed market participants. Retail sales posted -0.9% and 0.2% m/m in Jan 25 and Feb 25, respectively, both severely undershooting expectations. The University of Michigan Consumer Sentiment index fell to 57.9 in Mar 25, its lowest since Nov 22. Survey results point towards tariff fears and uncertainty as to the underlying cause. Most significantly, the trade balance came in extremely weak at -USD131.4bn in Jan 25, the weakest on record. This fed through to the Atlanta GDPnow model, which nowcasted US GDP for 1Q25 to end at -2.8% y/y. This extremely poor forecast was primarily due to the import of gold, as investors feared a hypothetical gold tariff and sought to onshore the commodity. Since gold imports due to investment are not calculated within the GDP, the gold-adjusted GDPnow show a +0.4% y/y figure.

There are reasons to believe that the current sentiment regarding the US markets is overly pessimistic; however, without a catalyst, a reversal in market positioning is unlikely. Macro data may beat market expectations from here on out, but this is likely due to an overly pessimistic market sentiment rather than genuine strength. This would likely be insufficient to start an asset rally.

The key date will be 2 Apr 25’s retaliatory tariff deadline set by Trump. Many market participants have their expectations raised due to insider reports that the tariffs will be scaled down and exempt certain allied countries. 2 Apr 25 tariffs will almost certainly hit China hard as discussed above, but the uncertainty lies in the tariff on allies.

The bear scenario is that the tariffs will be scaled down but not as much as people expect. Trump’s administration will still consider VAT, product standards and regulatory hurdles as forms of tariffs in calculating their retaliatory tariffs. This scenario will exempt a few countries, especially not the European Union. Due to recent market run-ups, this scenario will unwind the long positions gathered in these few weeks.

The bull scenario is that the tariffs will be heavily scaled down to only match the tariffs faced by US firms. This means that Trump will not calculate non-tariff trade barriers in the size of the retaliation. Reports currently suggest that countries with a trade surplus with the US will be exempted. This would spare Netherlands, Australia, UK and Singapore but still hit Canada, Mexico and the EU. This scenario will likely lead to a short market rally due to policy clarity.

For this article, the most relevant consideration will be on the US corporate credit spreads. The spreads have been exceptionally narrow since Jan 24. US exceptionalism improved the viability of US corporate balance sheets and raised investor sentiment on corporate bonds. Since the US market sell-off in Feb 24, US corporate credit spreads have slightly widened but are still quite tight by historical levels.

In the bear case, I would expect some short-term volatility as they reverse their long positions in US assets. This would disproportionately impact the corporate bond market as market participants reconsider the US growth story. Credit spreads will likely widen in the weeks following 2 Apr 25, with poorer-than-expected macro data taking over as the catalyst for the corporate bond market sell-off. The sell-off may pause on better-than-expected inflation data as the market expects deeper cuts than the current options implied 2-3 cuts in 2025.

In the bull case, there will be a nice tightening of credit spreads as market participants return to US assets. Many would take any softening of tariff stance as the end of the tariff story from Trump. As of writing, I do think that such thinking is premature; Trump has not signalled any intention to soften his foreign policy stance. Regardless of the immediate market reaction, the medium-term bias is for US economic weakness as high-income pulls back from spending and investing. The market will turn bearish once macro data turns out to be soft, especially if the high-frequency labour data softens or economic activity metrics (PMI, retail sales, or GDP) weaken. I maintain the view that the US, in 1H25, has more gloomy days ahead.

Takeaways

As the US market weakens while the Chinese market strengthens, there exists a nice opportunity to exploit the diverging of fates. In general, the Chinese bond market should continue to rally as fiscal and monetary policy shifts should encourage improved investor sentiments. The US corporate bond market will face opposite pressures as I view the US macro environment to be generally weak. This means that for participants looking to find opportunities in USD assets, investing in investment-grade, USD-denominated Chinese corporate bonds might be ideal. We do note that this hinges on the continuation of current macro trends.